50% of the world’s gross domestic product (GDP) is dependent on nature and biodiversity. With the current world GDP at nearly $100 trillion that’s nearly $50 trillion at stake. Additionally, every dollar invested in restoration creates up to 30 dollars in economic benefits. Therefore it’s easy to see that risk to our climate also equates to risk in investment.

The challenge within sustainable finance is a profound disconnect between the environmental, social, and governance (ESG) data asset managers need and what’s available to them. Asset managers lack consistent and accurate data. Investment managers need in-house research to mitigate ratings flaws and tap the $50 trillion ESG boom. In short, as the climate changes, corporations and financial institutions need to understand how it affects assets and operations, now and in the future.

The rise of spatial finance

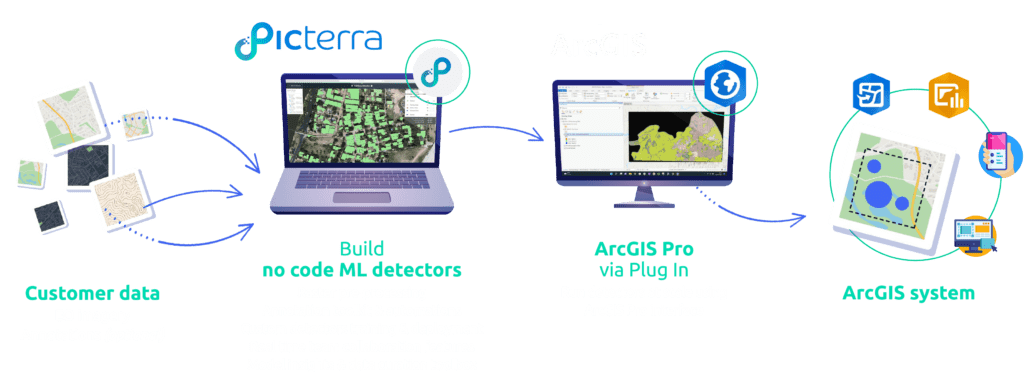

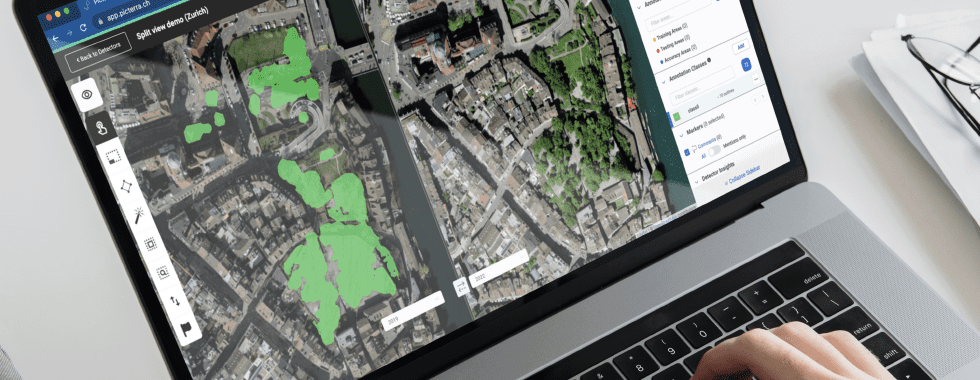

Spatial finance combines innovative geospatial intelligence technologies including a modern GIS platform, remote sensing, and artificial intelligence.

In a recent report by the World Bank and WWF it was identified that “in order to gain better environmental and climate spatial financial insights, there is a need for up-to-date, high resolution environmental or climate observational datasets covering metrics across a wide portfolio to analyze asset data against.” These datasets are the fuel for spatial finance and need to be irrefutable and trustworthy.

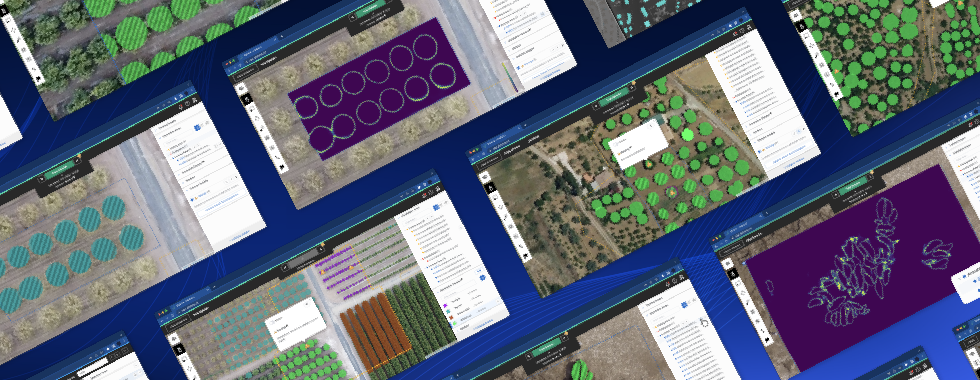

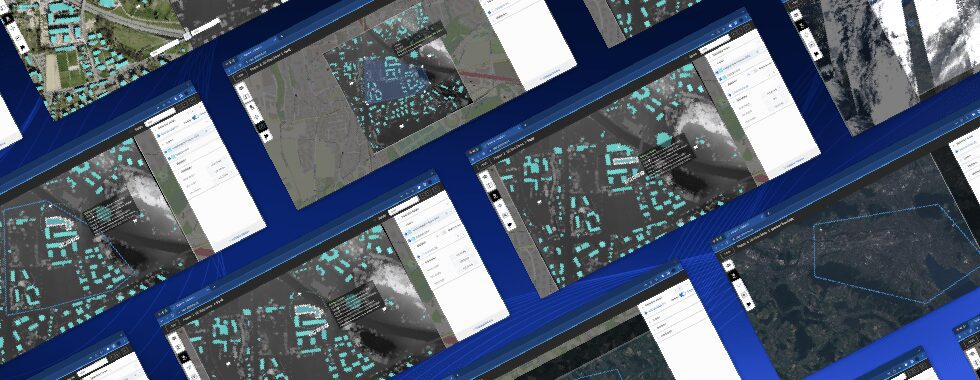

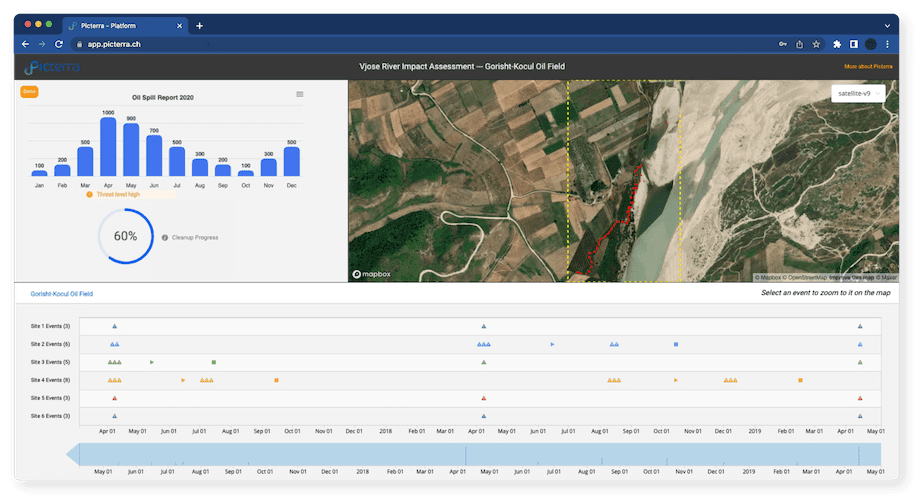

Geospatial intelligence from satellites is the ‘ground truth’ of ESG metrics. A no-code geospatial platform enables banks, insurance companies, and financial consultancies to streamline and scale the collection, analysis, and reporting of ESG metrics for a diverse range of use cases including:

- Investment decisions – anticipate places where business outcomes and sustainability priorities might be at odds, or where they are in sync.

- Risk modeling – analyze built and natural assets’ exposure to climate risks like illegal logging, deforestation, desertification, emissions, water pollution, biodiversity loss, and more.

- Embed machine learning-powered geospatial data in investment and verification decisions

- Discover early — and quantify — the biggest vulnerabilities and opportunities across investments to create resilient portfolios with risk-adjusted returns.

Assign an economic value to ESG data

Minimizing emissions, protecting habitats, and other activities that preserve the natural world and lessen climate risks are of increasing importance to financial institutions who often need to make long-term investment decisions.

By investing in a geospatial intelligence software platform these institutions gain a new capability to analyze their imagery and integrate with existing analytical software and workflows. Spatial finance analysts can keep up with increasing market demand for variable ESG data with versatile models that can be extended to many different object types.

Models can be built in days rather than months for feature extraction and change detection for objects such as crops, buildings, solar panels, pipelines, roads, water bodies, and much more.

Picterra enables you to avoid the expensive and time-consuming process of building machine learning capabilities in-house and replaces the manual work of risk profiling. Try it for yourself now with our free 45-day trial or get in touch to discover how to link economic value to a myriad of environmental factors.