Insurance industry – needs for scaling alternatives

These are challenging times for the insurance industry. More frequent and severe natural disasters result in a higher number of insurance claims and insurance frauds. Traditional damage documentation methods are becoming obsolete. They are too slow and too expensive. A post-storm damage assessment inspection of a single building tower, when done manually can take several days and cost more than $5000 -in men-hours and equipment rental- per day. Drone-based and automated damage detection analysis stands out as a fast, repeatable, and affordable alternative when it comes to inspection costs in the insurance industry.

What did they do before drones and automated detection stepped in?

Typically, with each insurance claim, there is a team consisting of about 2 to 6 insurance adjusters that would appraise, investigate, and create an assessment of the claim. For example, if there was a storm that caused severe damage to the roofs of residential houses, the team firstly would assess the damage directly on site. Roofs are notoriously difficult and hazardous to inspect however, and in order to quantify the damage, they would have to climb onto the roof to assess the extent of the damage, measure and document cracks, take pictures, etc. Along with that, fraud inspection is another important task that the team has to consider as the damage could have existed even before the claim. It’s usually a challenge for insurance adjusters to compare the property status before and after an incident. Insurance adjusters need to collect witness statements and speak with any government officials or specialists on the scene, which will take several days to proceed. This information gets compiled into a report, commonly known as a claim file, which will be presented to both the insurance company and the insured when a payment decision is reached.

So, what is the alternative?

Thanks to the development of innovative technology, we can now capture images with drones and use automated object detection to analyze the case. Doing so replaces all that grueling manual work. A report of PwC called “Clarity from above” stated out that the application of drone and AI technology to the insurance industry is anticipated to result in savings of up to $6.8 billion USD per year. Drones can reduce on-the-job injuries that have to be dealt with, saving money and time for the whole case. In particular, fraud monitoring is much easier as insurers can disprove fraud claims by using AI-powered object detection to analyze data, compare the level of damage before and after the event. Using the power of drones combined with automated object detection, the amount of time-solving a claim can be reduced between 25% and 50%. Furthermore, this tech not only speeds up the task of manual inspection but also results in higher rates of accuracy and lower labor intensity.

How AI-powered damage assessment can cut down inspection costs in the insurance industry?

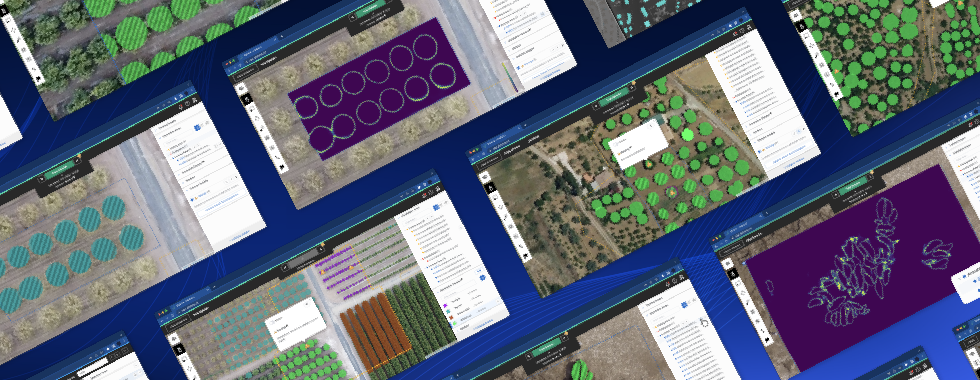

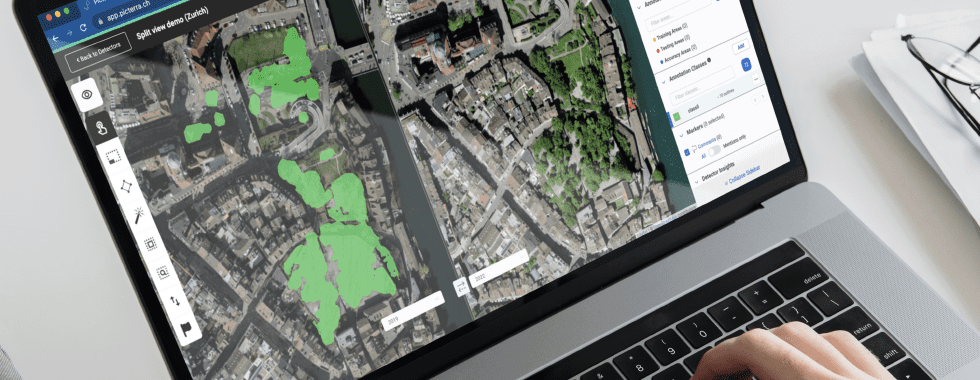

In this project, we will process an aerial image and detect damaged rooftop buildings using the Picterra Platform – Picterra’s platform for tailoring object detection/mapping algorithms to analyze images and localize features of interest. From that, we will evaluate how your company can benefit with the help of just one drone and the Picterra platform.

Firstly, you can capture aerial images using your drone and create an orthomosaic with photogrammetry software (e.g. Metashape, Pix4D, DroneDeploy, nFrames, correlator3D, etc.) and upload it in TIFF format to Picterra Platform.

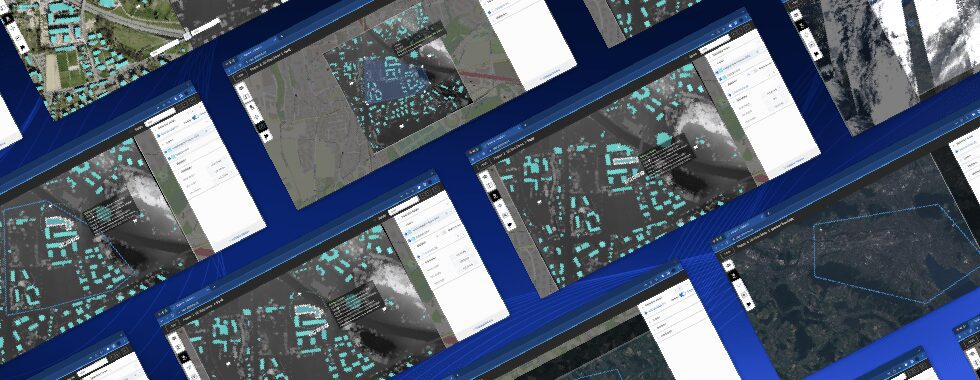

Coming to this case, we have two orthomosaics captured over two areas after a disaster, one is located in Japan, and the other one in Dominica. We will inspect and compare the level of damage over these two areas.

In this scenario, our image is quite large the visual size of what we need to detect in the image is quite small. It will be more accurate and convenient to detect them using artificial intelligence.

As a result, we will build a custom detector for ruined rooftop buildings that you can later use for your own insurance claim project.

After running the detection, there are 201 ruined rooftops in Japan and 106 in Dominica. It represents a surface roof damage of 27’872 meter square distributed throughout the images. The whole detecting process only takes us about 30 minutes with one person that oversees the work.

Moreover, the detector is robust and has been trained in two different environments. Thus, it can provide generalization and be deployed on other orthomosaics.

So how much a drone and AI-powered object detection can reduce inspection costs in the insurance industry?

By assessing the damage using drones combined with AI-powered object detection, insurers can save more time, money, and resources for claim management. Instead of having a team of adjusters conducting insurance claims and having the result after days of processing, companies can take just half an hour to fly the drone and another half hour to detect damages.

Moreover, as images and detectors are all stored on the cloud, it means that the detectors can be used in further cases on different images. A detector can be scaled to all your projects in a few clicks.